Reducing your Compliance spend

As your firm starts doing new things and you find you have different rules and regulations to comply with where do you start? For many it begins with a Google search. The success of your Googling can come down to…

As your firm starts doing new things and you find you have different rules and regulations to comply with where do you start? For many it begins with a Google search. The success of your Googling can come down to…

Since the outset of the Covid-19 outbreak in the UK PRA and FCA have been asking firms about their risk management and specifically looking to understand if firms are identifying any new or evolving risks. FCA especially has been concerned…

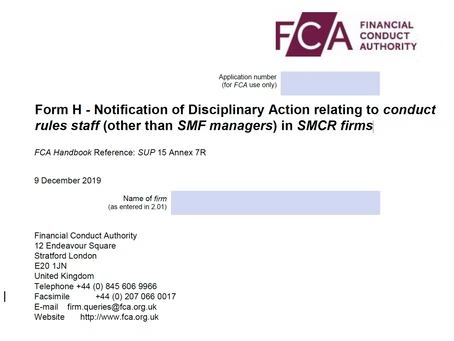

Form H is the Notification of Disciplinary Action relating to conduct rules staff (other than SMF managers) in SMCR firms which is also known as REP008 in GABRIEL. Your breach report must cover breaches from 1 September 2021 to 31…

Last week’s blog about the recent FCA CASS Dear CEO letter has prompted many questions, and particularly about the matched principal exemption. This is a brief note to address those common questions about the matched principal exemption. What is the…

On Friday (24 July 2020) the FCA sent out a Dear CEO letter to wholesale brokers about use of title transfer collateral arrangements and the matched principal exemption. The FCA call to action is for all firms who receive the…

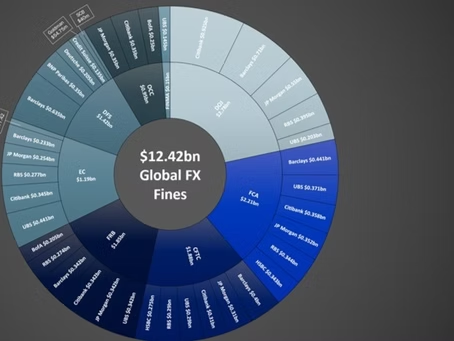

Actually $12.42 bn is the total FX fines paid: 24 of which were levied on 5 banks, the “cartel banks” totalling $12.270bn Most of the rest were for use of customer information to rig transactions. This led to an erosion…

The FCA has been providing more reminders to firms to treat market abuse as a sub-set of financial crime. Both insider dealing and market manipulation are criminal offences. Both offences need some form of engagement with, or access to, financial…

FCA has released some new transaction reporting data which rather surprisingly states there are still no Skilled Person reviews on transaction reporting and no ongoing investigations [in Enforcement]. Although FCA does make the point that the Final Notice issued to…