The financial markets thrive on integrity and trust. Regulators, investors, and counterparties expect that prices are formed in fair, transparent, and competitive markets. The Market Abuse Regulation (MAR) is central to this expectation. It sets a clear framework that prohibits manipulation, insider dealing, and misleading practices.

However, recent high-profile cases, including the collapse of prosecutions against Tom Hayes (LIBOR) and Mark Johnson (FX fixing), highlight an uncomfortable reality. Some behaviours may feel like misconduct, but the courts ultimately found they were not criminal based on the laws of that time.

LIBOR and FX Trials: Not Guilty?

Both Hayes and Johnson faced allegations of market manipulation. Hayes, nicknamed “Tommy Chocolate” for choosing this favourite beverage over beer during trading-floor pub outings, was once labelled the “ringmaster” of LIBOR rigging and served several years in prison before his conviction was overturned this summer. Johnson, meanwhile, was accused of front-running a major FX trade while at HSBC. After years of legal battles, his conviction was also quashed.

In both cases, there was little dispute that their conduct fell short of today’s standards. Traders were accused of gaming benchmarks, tipping off colleagues, or trading ahead of client orders. This was perceived to disadvantage clients and counterparties. On the face of it, this seemed like market abuse in its purest form.

However, the courts concluded otherwise. The laws, as drafted at the time, were either too vague or unsuited to capturing the behaviour in question. What regulators and the public saw as abusive and unfair was not, legally speaking, a crime. This raises an uncomfortable truth – wrongdoing and criminality are not always the same thing.

LIBOR and FX Lessons

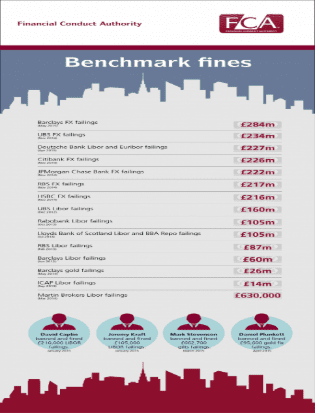

Despite the acquittals of Tom Hayes and Mark Johnson, a refund for the banks is not going to happen for the historic LIBOR and FX fines levied against this type of misconduct. The core reason is that the fines were not solely based on the criminal convictions of a few individuals. Instead, they were levied against the banks for systemic, firm-wide failings in their controls, supervision, and culture.

Regulatory bodies, such as the FCA in the UK and the CFTC in the US, explicitly stated that the banks’ internal systems allowed for a “free-for-all culture” where traders could put their own interests ahead of clients, manipulate benchmarks, and engage in misconduct.

The acquittals of Hayes and Johnson simply indicate that the prosecution was unable to prove individual criminal guilt for conspiracy to defraud beyond a reasonable doubt in those specific cases, with the Supreme Court ruling that directions given to the jury at the end of Mr Hayes trial were incorrect, meaning their convictions were found to be unsafe.1 They do not, however, negate the extensive evidence of widespread poor conduct, weak governance, and a lack of oversight within the banks themselves that the regulators identified and fined.

The ability to identify and manage conflicts of interest is essential to maintaining fair and transparent markets. Failures, such as those seen in relation to LIBOR submissions, demonstrate how unmanaged conflicts can distort decision-making and damage trust. Firms must ensure robust frameworks, clear accountability, and active oversight to prevent similar risks arising.

MAR’s Purpose

This is precisely why MAR exists. It plugs the gap between “sharp practice” and criminal fraud. Under MAR, regulators can sanction actions, using civil law with its’ lower burden of proof, that mislead the market, manipulate benchmarks, or create a false impression of supply and demand. This applies even if they fall short of being criminal offences.

Why The Global FX Code Matters

This is where voluntary standards, such as the GFXC’s FX Global Code, are important. Unlike the court system, which regulators use to enforce against criminal offences, codes and regulatory frameworks set broader expectations for behaviour. For example, the FX Global Code register shows leading market participants publicly committing to the Code, having undergone significant internal governance and controls exercises. This register is more than a static list; it is also a barometer of industry engagement. You can review your firm’s adherence to the code by visiting the official register. Visit our website for a deeper understanding – FX Global Code Implementation Planning

Trend Analysis: Who’s Keeping Up?

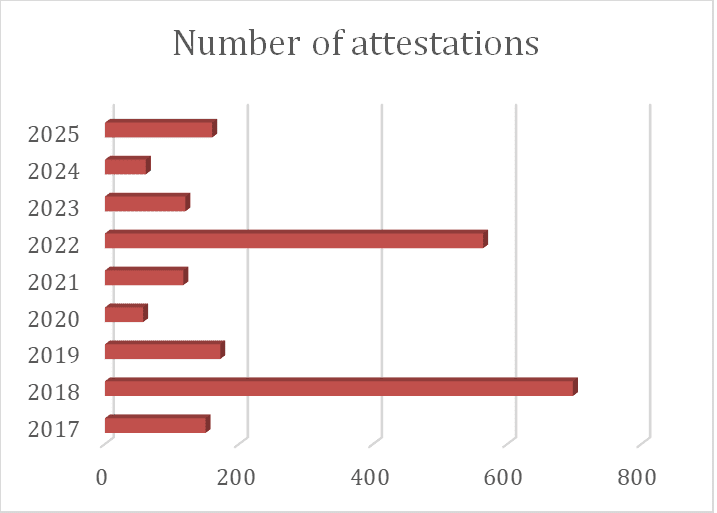

Looking at the data over time, we see clear patterns emerge. 2017–2018 saw a surge of adoption. More than 800 published commitments as the Code gained traction. Updates then slowed, with only 38 renewals in 2020. This reflects pandemic disruption. A significant rebound came in 2022, when more than there were over 500 updated statements.

This was a sign of renewed regulatory and client scrutiny. In contrast, 2024 saw just 61 updated commitments. Activity picked up a little again in 2025 with 160 public commitments so far.

This uneven pattern suggests that while many institutions rushed to adopt the Code early, fewer have maintained the discipline of regularly refreshing their commitment and control environment. Consequently, this could pose reputational or supervisory risks, especially when viewed through the lens of MAR.

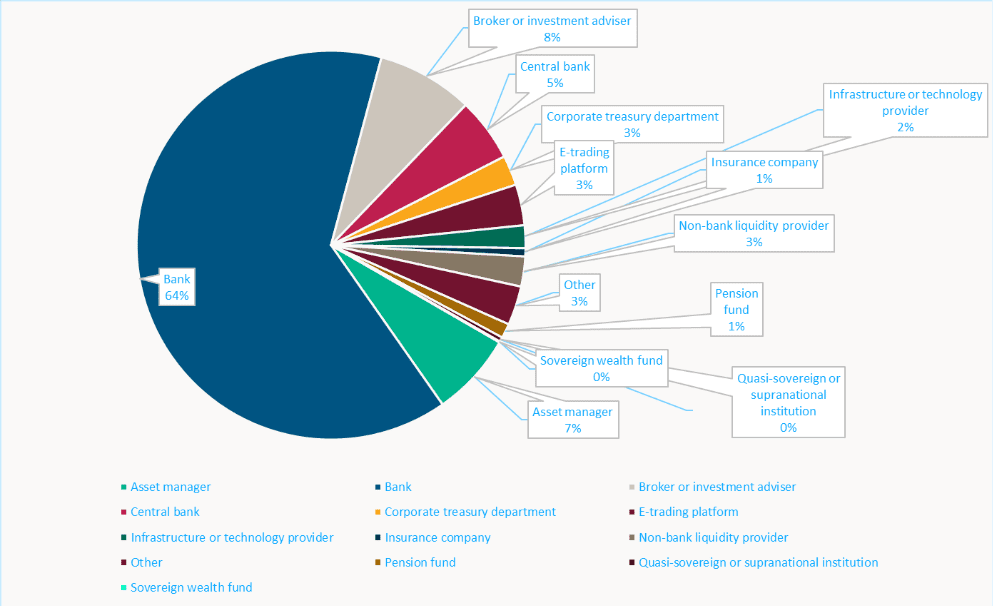

Banks continue to be the most dominant participants in updating the Global FX Code, representing 64% of all attestations. In contrast, the asset management industry accounts for just 6.9%. The next largest group is brokers and investment advisers, contributing 8% of attestations.

A Warning for Firms

The lesson for firms is clear: courtroom verdicts are not the benchmark for good conduct. An acquittal does not equate to doing the right thing. Regulators apply a broader lens shaped by enhancements made to MAR, and other regulations post these cases and by standards set in codes such as the FX Global Code.

Therefore, firms should:

- Review adherence registers not just as a compliance tick-box, but as a living commitment to market integrity, challenge counterparties, and clients about adhering.

- Review systems and Controls regularly and update them to reflect identified firm risks, industry trends, and regulatory enforcement.

- Ensure conflicts of interest are identified, assessed, and managed transparently to prevent distorted decision-making and protect market integrity.

- Train your staff that “not illegal” is different from “acceptable.” Regulators and clients expect higher standards.

- Monitor your conduct risk carefully, recognising that reputational damage can arise even when cases collapse in court. Visit our training page for more information.

Closing Thought

The fall of these individual LIBOR and FX prosecutions might suggest to some that the system failed. It highlights something else: laws and criminal courts are blunt tools for regulating conduct in complex markets. This is why MAR, conduct codes, and regulatory enforcement are so critical. They ensure that even when criminal law cannot deliver a conviction, misconduct does not go unchecked. In markets, as in life, being found “not guilty” does not always mean you did nothing wrong.