Regulatory Change

Regulatory intelligence that actually understands your business

Tailored FCA and PRA updates for financial services firms

Not another generic bulletin cluttering your inbox

Your inbox is full of regulatory bulletins, most irrelevant to your firm. Meanwhile, the one change affecting your authorisation scope slips through unnoticed. Large firms have dedicated teams filtering this noise and flagging what’s critical. You need the same rigorous analysis – someone who understands your business model, spots what matters, and tells you what to do about it.

Recent regulatory developments our clients are tackling include: embedding Consumer Duty, updated CASS rules, PRA operational resilience expectations, changes to data reporting requirements.

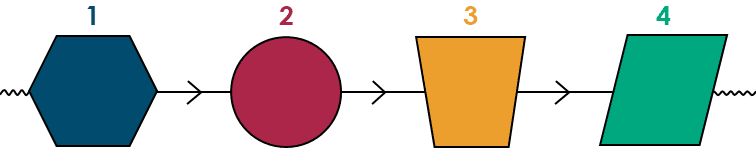

How It Works

Step 1: We understand your business

Brief onboarding call to map your authorisation scope, business model, and regulatory risk areas.

Step 2: Weekly curated intelligence

Every Monday, you receive an email containing only the FCA/PRA changes relevant to your firm, with our analysis of what it means and what action you should take.

Step 3: Monthly deep-dive

One in-depth analysis each month examining a significant regulatory development affecting your sector.

Step 4: Direct access

Questions about implementation? Quick call or email to discuss implications for your specific situation.

What makes this different?

We’ve built regulatory intelligence functions at global financial institutions with assets exceeding £500bn, monitoring FCA, PRA, and international regulatory developments for firms operating across multiple jurisdictions. We’ve monitored regulatory change through MiFID II implementation, Senior Managers Regime rollout, and Consumer Duty introduction at institutional scale.

The difference between catching a regulatory change three weeks early versus three weeks late can be the difference between smooth implementation and expensive remediation. We know – we’ve seen both outcomes at institutional scale.

Most financial services firms can’t justify a dedicated regulatory intelligence team. But you still need someone who reads every FCA consultation, catches the implications in PRA policy statements, and understands how seemingly generic guidance applies to your specific business model.

That’s what we do.

why firms choose us

No long-term contracts – monthly rolling arrangement, cancel anytime

Rapid onboarding – typically operational within one week

Tailored from day one – not a generic feed you have to filter yourself

Direct access – quick calls or emails when you need clarification on implementation

Institutional rigour without institutional cost – the same quality analysis major banks use, priced for smaller firms

Discretion assured – we don’t publish or share client lists

We are a team of former regulatory policy professionals and former heads of regulatory intelligence at global banks and brokers. We don’t just read what regulators publish – we understand what they mean, and more importantly, when something that looks irrelevant actually matters to your specific business model.

ready to get started?

See it in action

Download a sample regulatory intelligence report for your sector and see exactly how we cut through the noise.